Fascination About Feie Calculator

Table of ContentsGet This Report on Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.A Biased View of Feie CalculatorFeie Calculator Things To Know Before You Get ThisSome Known Factual Statements About Feie Calculator

He offered his United state home to develop his intent to live abroad completely and used for a Mexican residency visa with his partner to help fulfill the Bona Fide Residency Test. Neil points out that purchasing building abroad can be testing without very first experiencing the area."It's something that individuals need to be truly thorough about," he says, and suggests expats to be cautious of typical mistakes, such as overstaying in the United state

Neil is careful to cautious to Stress and anxiety tax united state that "I'm not conducting any business in Service. The United state is one of the couple of nations that tax obligations its citizens no matter of where they live, suggesting that also if a deportee has no revenue from U.S.

tax returnTax obligation "The Foreign Tax obligation Debt permits individuals functioning in high-tax nations like the UK to counter their United state tax obligation liability by the quantity they've already paid in tax obligations abroad," claims Lewis.

Feie Calculator Things To Know Before You Buy

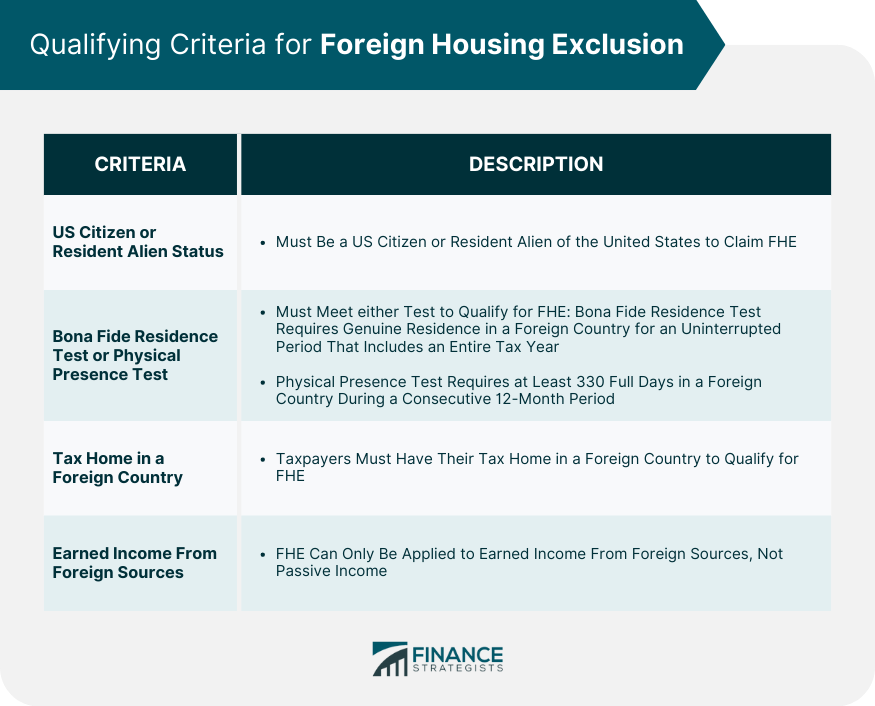

Below are a few of one of the most regularly asked inquiries concerning the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit as much as $130,000 of foreign-earned income from federal earnings tax obligation, minimizing their united state tax responsibility. To receive FEIE, you need to fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Home Examination (prove your primary residence in a foreign nation for a whole tax year).

The Physical Existence Test needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Test also needs U.S. taxpayers to have both an international revenue and a foreign tax obligation home. A tax home is defined as your prime location for company or employment, no matter of your family members's residence.

The 15-Second Trick For Feie Calculator

An earnings tax obligation treaty between the U.S. and an additional nation can help protect against dual taxes. While the Foreign Earned Revenue Exemption decreases gross income, a treaty might supply additional benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a required filing for united state citizens with over $10,000 in foreign economic accounts.

Qualification for FEIE depends on conference details residency or physical visibility examinations. is a tax obligation advisor on the Harness platform and the creator of Chessis Tax. He belongs to the National Organization of Enrolled Representatives, the Texas Society of Enrolled Representatives, and the Texas Society of CPAs. He brings over a decade of experience working for Big 4 companies, suggesting expatriates and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax consultant on the Harness system and the founder of The Tax Man. He has more than thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxation, cannabis taxes and divorce associated tax/financial planning matters. He is an expat based in Mexico - https://www.4shared.com/u/lv_2m1o8/louisbarnes09.html.

The foreign made earnings exclusions, sometimes referred to as the Sec. 911 exclusions, exclude tax on salaries made from working abroad. The exclusions make up 2 parts - an income exemption and a housing exemption. The adhering to FAQs talk about the benefit of the exemptions including when both spouses are deportees in a general fashion.

Feie Calculator for Beginners

The tax advantage leaves out the income from tax at bottom tax rates. Previously, the exemptions "came off the top" minimizing revenue subject to tax obligation at the leading tax that site rates.

These exemptions do not spare the earnings from United States tax yet just offer a tax obligation reduction. Keep in mind that a bachelor working abroad for all of 2025 that earned regarding $145,000 without various other income will have taxed revenue minimized to zero - properly the very same answer as being "tax complimentary." The exemptions are computed each day.